Introduction

Over the last ten years, the Indian fintech ecosystem has grown quickly, and one of the most well-known names to come out of this change is Groww. Millions of people have turned to platforms that make it easier to invest in mutual funds, equities, and other financial instruments as retail investment has gone digital. As the firm becomes more popular, more and more people are interested in the groww share price. This is especially true for investors who want to know how much the company is worth, who owns it, and when it might go public. People are still interested in how much Groww is worth, even though it isn’t a publicly traded corporation yet.

To understand the groww share price, you need to look at the company’s business model, how it has been funded in the past, where it stands in the market, and what its long-term plans are. This article gives a full and useful description of Groww, covering what its share price implies for a company that isn’t listed, how its value is determined, and what investors can expect in the future. By the conclusion, you’ll know exactly why Groww is so popular in India’s finance market.

What is Groww as a Fintech Platform?

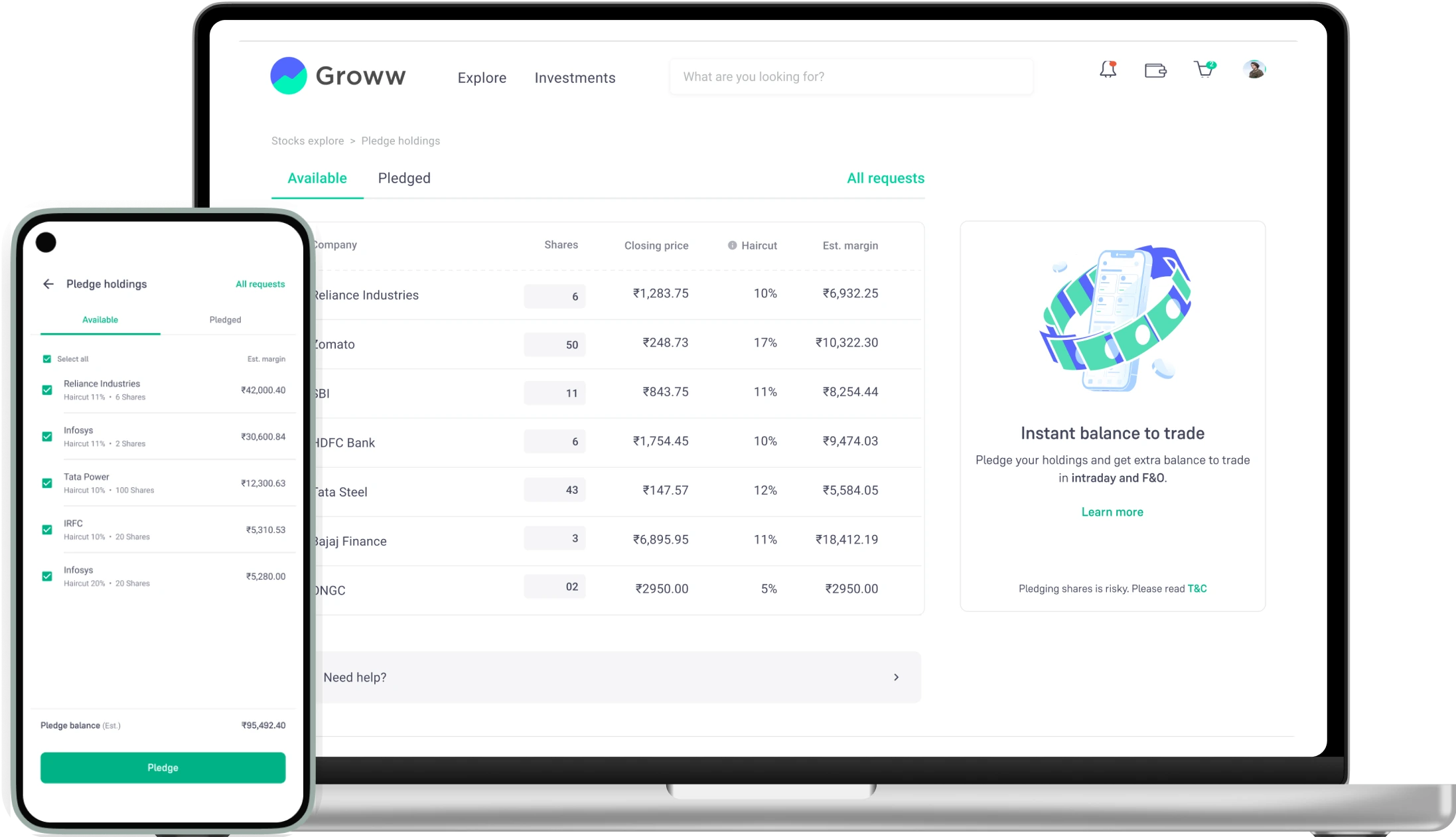

The simple but powerful idea behind Groww was to make investment available to everyone. People used to think that investing in India was hard, required a lot of paperwork, and was scary for newcomers. Groww changed this idea by providing a clear digital interface, simple onboarding, and easy access to stocks and mutual funds.

As the platform got bigger, it included stockbroking, exchange-traded funds, and other types of investments. This quick growth led to questions about the groww share price, even though the company is still privately owned. Investors generally think that a company with a strong brand and a lot of users is worth a lot of money, and Groww has built both of these things.

What does the Groww share price mean for a company that isn’t listed?

Groww does not have a daily stock price set by the market, unlike publicly traded companies. So, when individuals look up the groww share price, they are usually talking about one of three things: how much the company is worth during funding rounds, prices in private or unlisted marketplaces, or what people think will happen when the company goes public.

In private corporations, the share price is usually the value of the company divided by the number of shares that are still out there. This value is based on things like revenue growth, potential for profit, number of users, and overall market mood. Because Groww has gotten money from well-known investors, these funding rounds have had a big impact on how people think about the groww share price.

Funding History and Growth in Value

Groww has gotten money from well-known venture capital firms and strategic investors. Each round of funding has shown that people are more confident in the platform’s potential to grow and its long-term prospects. Because of this, the estimated groww share price has gone up with each round, showing that investors have a lot of faith in the company’s future.

Funding values don’t just look at present revenue; they also look at expected growth, being the leader in technology, and being the biggest player in the market. Groww’s rising value is mostly due to its ability to get and keep a lot of users. That’s why talks about the groww share price frequently focus more on what it could do in the future than what it does now.

Business Model and Ways to Make Money

The company’s business plan is a big reason why the groww share price is going up. Groww makes most of its money from brokerage fees, commissions, and other services. Its change from a platform for merely mutual funds to a full-service investment app greatly increased the number of people who could use it.

The platform’s focus on being clear and easy to use has drawn in first-time investors, many of whom still use Groww as their main investment gateway. This ongoing interaction makes it easier to estimate revenue, which is a crucial factor to consider when figuring out the implied groww share price and valuation.

Where the market stands and how it compares to others

Groww works in a competitive fintech space that comprises discount brokers, established banks, and new digital companies. Groww has found a solid niche in a very competitive market by focusing on teaching users and making things easy.

Brand trust and market leadership are two intangible assets that have a big effect on valuation. Even though there isn’t any public market trading, these things make people think better of the groww share price as Groww adds more products and users.

Expectations for IPOs and how investors feel

A possible initial public offering is one of the main reasons why more people are interested in the groww share price. There hasn’t been any official word yet, but some who follow the industry think that the company could go public after it meets certain size and earnings goals.

People are often interested in unlisted shares early on because they want to get in before the firm goes public and its value goes up. Because of this, the groww share price has been a hot topic among both retail and institutional investors.

Risks and problems that affect valuation

When talking about the groww share price, you have to talk about hazards too. Changes in regulations, market instability, and more competition can all affect the value of fintech companies. Also, it’s hard for any platform that is growing quickly to keep up with service quality.

Investor feelings can change quickly, especially in fields that are driven by technology. Groww has shown that it can handle problems, but how well it does them in the future will affect its value and the predicted groww share price.

User Experience, Technology, and Innovation

Groww’s success is based on technology. The platform’s easy-to-use design and dependable performance have been very important in gaining users’ trust. Continuous innovation makes customers happier and keeps them coming back, both of which are important for long-term value.

Strong IT infrastructure lowers operational risks and makes it easier to grow. These things indirectly boost confidence in the groww share price since investors like companies that can grow without sacrificing reliability.

Long-Term Growth Outlook

The retail investment market in India is still growing, and millions of potential investors have not yet joined. Groww is in a good position to take advantage of this trend because it got in early and has a strong brand name.

Long-term growth potential are an important part of valuation analysis. People who watch the market are still hopeful about the groww share price, even though more people are using digital tools and learning about money.

Conclusion: Knowing the Real Worth of Groww

The groww share price isn’t just a number that shows up on a stock exchange ticker. It is instead a mix of assessments of value, investor expectations, and the possibility for future growth. Groww is a fintech firm that isn’t listed on any exchanges. Its value is based on funding rounds, its position in the market, and its long-term goals, not on daily market changes.

For investors and fans, learning about Groww’s fundamentals gives them more information than just looking at a hypothetical share price. Groww’s story shows how innovation, consumer trust, and scalability can create a lot of value in the modern financial world, whether or not it goes public in the future.

Read More:- Apkek Org: Complete Guide to Features, Safety, and Usage