Introduction

Since Groww went public, the price of its shares has been one of the most talked-about things in Indian financial markets. Groww is a top digital brokerage and investment platform that has become quite popular with individual investors. This is immediately reflected in the Groww share price. Investors, market analysts, and traders keep a careful eye on this stock to see how the company is doing and how the overall sentiment in the fintech market is changing.

In this article, we will give a detailed look at the Groww share price, look at its past performance, go over its quarterly financial statements, talk about the main factors that affect the stock, look at what analysts think, and give a market outlook.

Today’s Groww Share Price: A Look at the Market

The Groww share price is between ₹173 and ₹175 as of early 2026. This is a big jump from the initial public offering (IPO) price of ₹100 per share. The stock has grown a lot since it went public because more people are interested in fintech companies, the company is making more money, and it is adding more financial products.

The Groww share price has ranged between ₹112 and ₹194 over the past 52 weeks, showing that it is both volatile and has room to expand. This range shows how changes in investor mood, market conditions, and company performance affect the stock price.

Table 1: A quick look at the Groww share price

| Metric | Value |

|---|---|

| Current Groww Share Price | ₹173–₹175 |

| 52-Week High | ₹194 |

| 52-Week Low | ₹112 |

| Market Capitalization | ~₹1,01,400 crore |

| P/E Ratio | ~67 |

| Dividend Yield | 0% |

| Stock Exchanges | NSE & BSE |

The table above gives a clear picture of the current state of the Groww share price, which is useful for investors who are thinking about buying the stock.

The past performance of the Groww share price

Groww’s initial public offering (IPO) price was ₹100 per share. The first listing got a lot of investors excited, which caused the Groww share price to go up right away. Within the first few days, the stock price rose to close to ₹178, showing that there was a lot of demand for it and that people were confident in the company’s growth potential.

Even though early investors often took profits and made adjustments, the Groww share price has been steadily going up. More people are using digital investing platforms, the user base is growing, and revenues are rising across a number of financial products. These changes have all had an effect on each other.

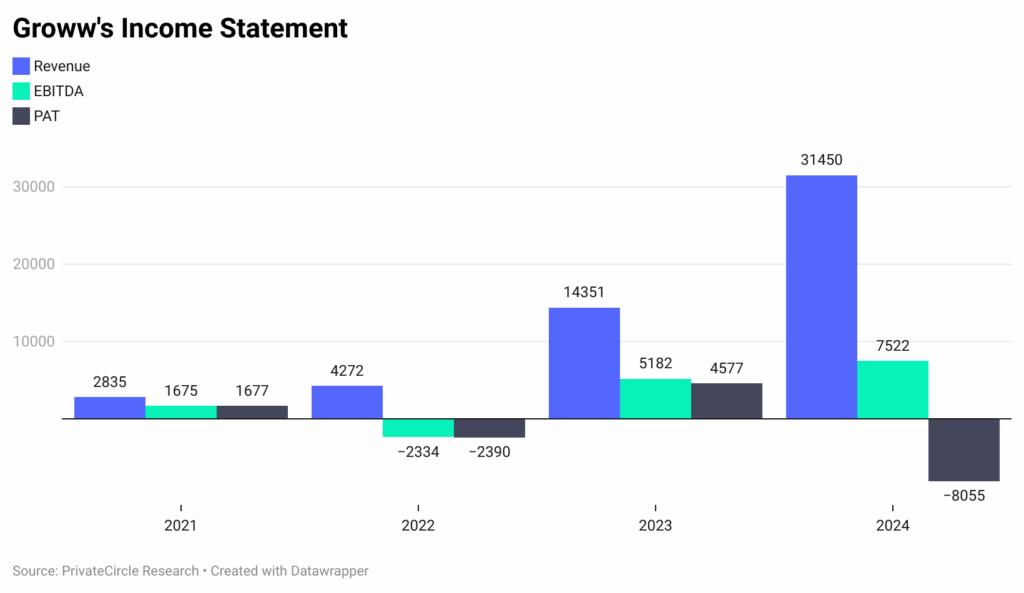

The Effect of Financial Results on Groww’s Share Price

The Groww share price is mostly based on how well the company does financially. The company made a net profit of ₹546.93 crore in the third quarter of FY26. This was a 27.8% drop from the same time last year, but it was mostly because of one-time gains in the preceding quarter. Adjusted operating profit went up a lot, which shows that the business was still doing well.

The company’s revenue for the quarter went by almost 25% over the same time last year, thanks to more trading in stocks, mutual funds, and other financial products. These outcomes have boosted investor confidence, keeping the Groww share price stable even when profits have gone up and down in the short term.

Table 2: Important Financial Information for Groww in Q3 FY26

| Metric | Value |

|---|---|

| Current Groww Share Price | ₹173–₹175 |

| 52-Week High | ₹194 |

| 52-Week Low | ₹112 |

| Market Capitalization | ~₹1,01,400 crore |

| P/E Ratio | ~67 |

| Dividend Yield | 0% |

| Stock Exchanges | NSE & BSE |

The table above indicates that even when the headline net profit goes down, the underlying revenue and operating measures provide investors confidence, keeping the Groww share price on a steady upward path.

Things That Affect Groww’s Share Price:

Business Growth

Groww began as a platform for distributing mutual funds, but it has now grown to include trading stocks, ETFs, IPOs, and derivatives. This diversification makes the Groww share price more stable against changes in the market and enhances revenue streams.

More and more people are using it

The platform has quickly garnered millions of users who are still using it. More retail investors in financial markets immediately affects investor confidence and, as a result, the Groww share price. The fact that the company is gaining market share among retail investors makes many think that it will grow quickly in the long term.

Investments with a plan

Investments in Groww Asset Management Company and other strategic companies have made people even more confident in the stock. The way investors feel about these changes helps keep the Groww share price stable and often higher.

What Analysts Think About the Groww Share Price

Most market experts have kept a bullish outlook on the Groww share price. Many brokerage reports talk about how the company has been growing steadily, adding new product lines, and being the best at digital investment platforms. Analyst ratings typically show how much a stock is likely to go up, which has a big effect on how people trade and how they feel about the market as a whole.

Risks That Could Lower Groww’s Share Price

Even if the company’s fundamentals are good, the Groww share price is nevertheless at danger of market volatility and regulatory issues. Changes in the economy, new rules for financial markets, or competition from other digital brokerage platforms could all have an effect on the stock’s performance. When investors think about possible gains and whether present Groww share prices can stay where they are, they should think about these things.

The Future of Groww’s Share Price

The Groww share price is likely to be affected by the company’s ability to add more products, get more consumers, and keep its revenue growth going over time. More growth in the Groww share price is possible if digital financial services keep coming up with new ideas and the company makes smart collaborations.

Analysts say that as India’s retail investment sector grows, platforms like Groww are in a good position to take greater market share. This might be good for the Groww share price in the years to come.

In conclusion

The price of Groww shares shows that the company is doing well in the market and that India’s retail investing industry has a lot of room to develop. Groww continues to attract investors since it has a large number of users, a variety of ways to make money, and good quarterly financial performance. There are dangers including changes in the market and rules, but the long-term outlook for the stock is still good.

When looking at the Groww share price, investors should think about both how it has done in the past and how much it could increase in the future. The company’s growth into new financial products, smart investments, and bigger market share make it a major participant in India’s digital brokerage business.

In brief, the Groww share price has strong fundamentals and a market that is focused on growth. This makes it an important company to keep an eye on for both long-term and short-term investors.

Read More:- CRPF VPN Outside Access Guide for Secure Remote Connectivity